What does it take for customers to adopt innovative AI techniques for their personal finances?

-

The goal was two-fold: gain insight on users’ trust level with AI and provide insight to industry leaders on how to proceed with AI in personal finance.

-

We conducted preliminary qualitative research that was designed to analyze people’s perspectives on introducing AI as a personal financial advisor. We utilized semi-structured interviews and coded analysis to develop a well-rounded and insightful overview of the potential client reception of future AI integration.

-

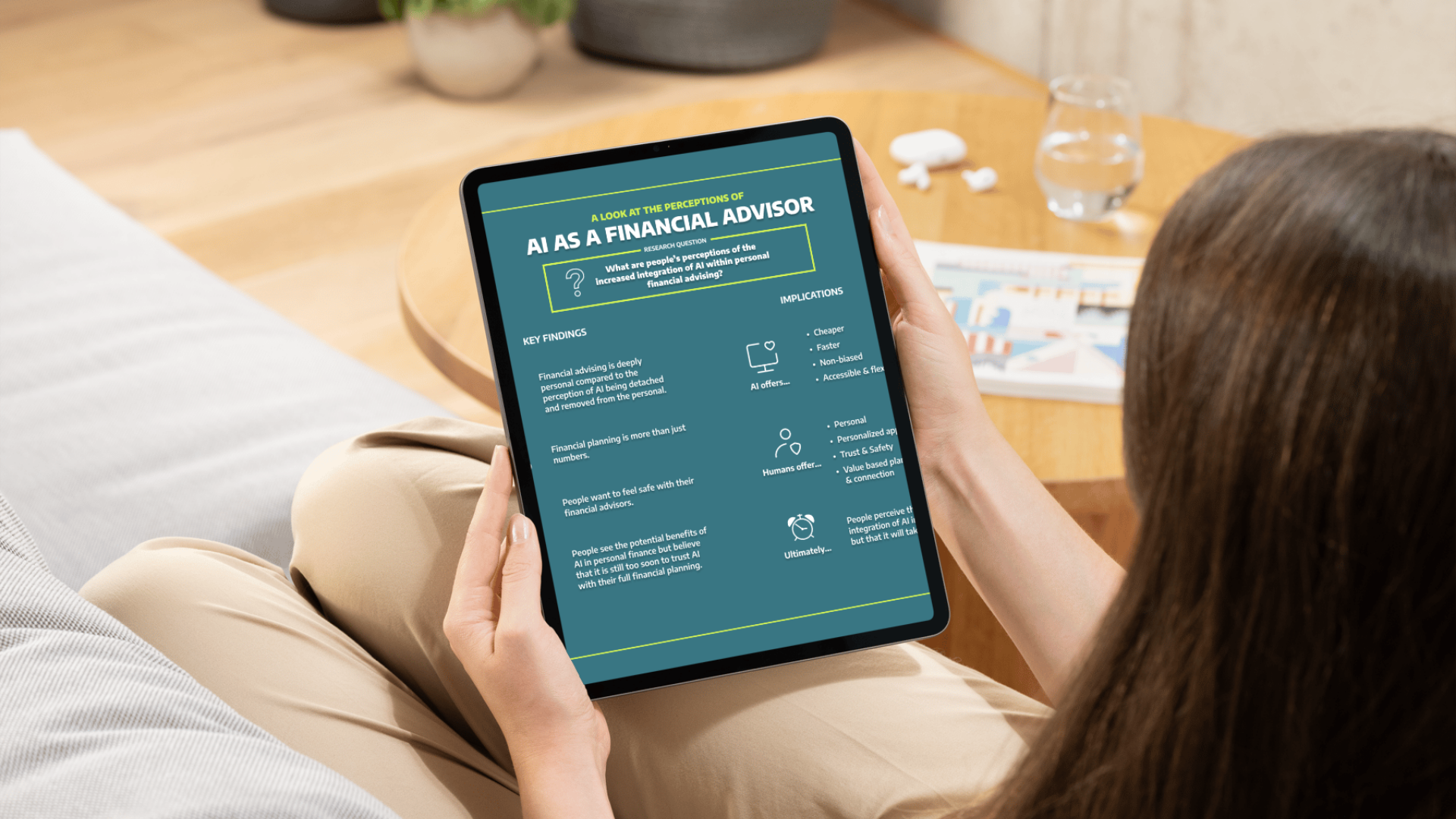

Overall, people’s perceptions when looking at AI integration within personal financial planning were related to the intangibles and immeasurables. Because financial planning is personal and not a “one-size-fits-all,” relational trust became a key component and would be an important aspect to address when increasing AI integration in personal financial planning.

While AI is cheaper, faster, non-biased, and accessible, a human financial advisor is personal, offering trust and safety, and a value-based approach.

Ultimately, people perceive the integration of AI inevitable, but that it will take time. When the time comes, the majority are looking for a hybrid approach.